Are you ready to enter the world of online trading? Opening an E*TRADE account is the first step towards accessing the stock market and managing your investments. Whether you are a seasoned investor or a beginner, E*TRADE offers a comprehensive online brokerage platform that provides secure trading, a wide range of financial services, and user-friendly trading tools.

With an E*TRADE account, you can trade stocks, bonds, mutual funds, ETFs, options, and futures. The platform offers real-time quotes, market commentary, and advanced research and data resources to help you make informed decisions. E*TRADE also provides two trading platforms, E*TRADE Web and Power E*TRADE, both of which offer powerful features and intuitive interfaces for seamless trading experiences.

To open an E*TRADE account, you will need to provide some personal information, such as your address, date of birth, and Social Security number or Employment Identification Number. You will also be asked to link a bank account to fund your trading activities. E*TRADE requires a minimum deposit of $500 within 60 days of opening the account to keep it active.

Once your account is set up, you can begin trading and investing in the stock market with the confidence of a secure and reliable brokerage platform. E*TRADE offers competitive trade commissions and a wide selection of no-transaction-fee mutual funds, giving you access to a diverse range of investment options.

Whether you are looking to grow your wealth, save for retirement, or explore advanced trading strategies, E*TRADE has the tools and resources you need to achieve your financial goals. Take control of your investments today by opening an E*TRADE account and start your journey towards financial success.

Key Takeaways:

- Opening an E*TRADE account gives you access to a wide range of investment options and trading tools.

- E*TRADE offers two trading platforms, E*TRADE Web and Power E*TRADE, with advanced features and user-friendly interfaces.

- To open an E*TRADE account, you will need to provide personal information and link a bank account for funding.

- E*TRADE requires a minimum deposit of $500 within 60 days of account opening to keep it active.

- E*TRADE offers competitive trade commissions and a variety of no-transaction-fee mutual funds.

Step 1: Start the Application

To begin the E*TRADE account application process, visit the designated webpage and select the option for an individual account. If you are a new E*TRADE customer, you will need to provide your first and last name, as well as your email address. If you are an existing customer, you can simply enter your user ID and password. Once you have completed this step, click “continue” to proceed.

Don’t have an E*TRADE account yet? No worries! It’s quick and easy to get started by following these simple steps. Let’s dive in:

Step 1: Start the Application

If you’re ready to open an individual account with E*TRADE, the first step is to visit our website and choose the option for an individual account. Whether you’re a new customer or an existing one, we have you covered.

- If you’re a new customer:

- Provide your first and last name.

- Enter your email address.

- Simply enter your user ID and password.

Once you’ve completed this step, click “continue” to proceed to the next phase of the application process.

| Step | Instructions |

|---|---|

| 1 | Visit E*TRADE’s website. |

| 2 | Select the option for an individual account. |

| 3 | If you’re a new customer, provide your first and last name, as well as your email address. If you’re an existing customer, enter your user ID and password. |

| 4 | Click “continue” to proceed. |

Step 2: Enter Your Personal Information

In this step, you will be required to enter your personal information. It is essential to provide accurate details to ensure your E*TRADE account is set up correctly.

Primary Account Holder Information:

| Information | Description |

|---|---|

| Address | Enter the residential address of the primary account holder |

| Phone Number | Provide a valid phone number for contact purposes |

| Social Security Number | Enter the Social Security Number associated with the account |

| Country of Residence | Select the country where you currently reside |

Additional Personal Information:

- Marital Status: Indicate whether you are single, married, divorced, or widowed

- Dependents: State the number of dependents you have, if applicable

- Current Employer: Provide details about your current employer, including the company’s name and your job title

Investment Profile:

Answer the following questions related to your investment profile:

- Annual Income: Specify your annual income from all sources

- Liquid Net Worth: State the liquid net worth, which refers to your assets minus liabilities

- Total Net Worth: Provide details about your total net worth, including all assets and liabilities

- Funding Sources: Describe the funding sources you plan to use for the E*TRADE account, such as personal savings or other investments

By accurately entering your personal information and investment profile, you ensure the proper setup of your E*TRADE account and enhance the security of your financial transactions.

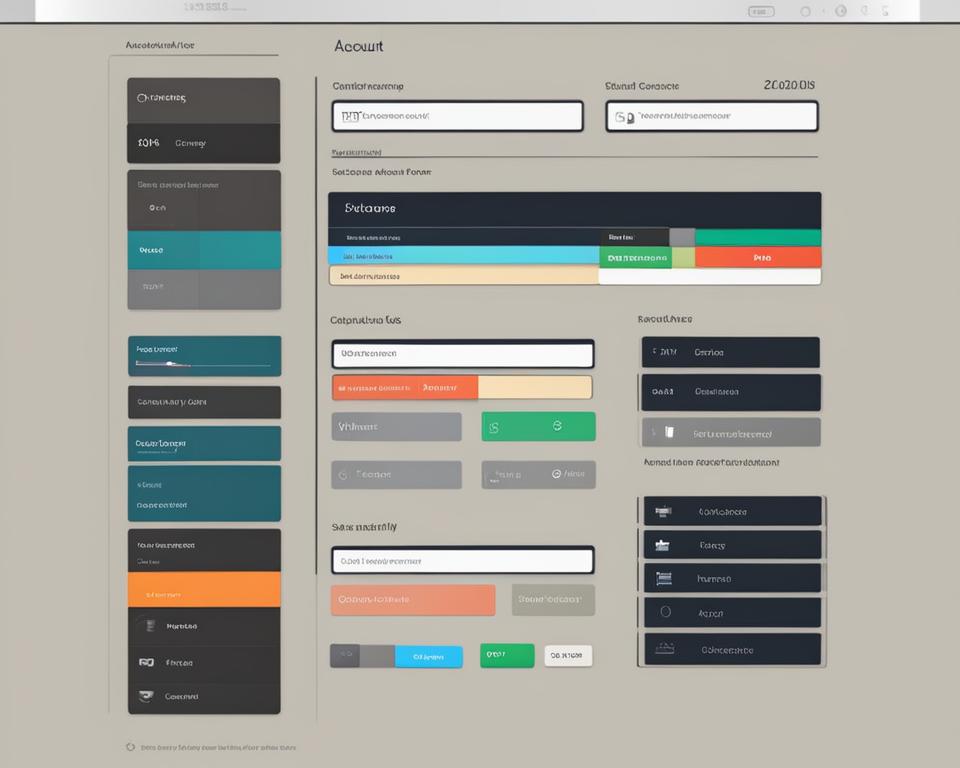

Step 3: Set Up the Account

In this step, you will be prompted to set up your account preferences. Start by selecting your preferred options for managing your uninvested cash. E*TRADE automatically places uninvested cash in a money market fund, and you can choose from several options to suit your needs.

Next, you will have the choice to access your account using a debit card or an E*TRADE checkbook. These features provide convenient ways to manage your funds and make transactions.

If you’re an experienced investor, E*TRADE offers advanced trading strategies such as margin trading and options trading. However, please note that these strategies are complex and may not be suitable for all investors.

Finally, you can customize the delivery of your account documents. E*TRADE allows you to receive your statements, confirmations, and other important documents either electronically or by mail. Choose the option that is most convenient for you.

| Account Preferences | Description |

|---|---|

| Uninvested Cash Management | Select how you want to manage your uninvested cash |

| Debit Card and Checkbook | Access your funds with a debit card or E*TRADE checkbook |

| Margin Trading and Options Trading | Advanced trading strategies for experienced investors |

| Document Delivery Options | Choose to receive account documents electronically or by mail |

Managing Uninvested Cash

When it comes to managing your uninvested cash, E*TRADE offers various options tailored to your preferences. These options include:

- Automatically placing uninvested cash in a money market fund

- Choosing to invest the cash in other available investments

- Transferring the cash back to your linked bank account

Debit Card and Checkbook

E*TRADE provides the convenience of accessing your account funds using a debit card or an E*TRADE checkbook. With a debit card, you can make purchases or withdraw cash from ATMs. The E*TRADE checkbook offers a more traditional method of accessing your funds through checks.

Margin Trading and Options Trading

“Margin trading and options trading are advanced strategies that may not be suitable for all investors. Please ensure you understand the risks involved before engaging in these types of trading.”

Document Delivery Options

E*TRADE gives you the flexibility to choose how you receive your account documents. Whether you prefer the convenience of electronic delivery or the tangible copies delivered by mail, you can customize your document delivery options to best suit your preferences.

Step 4: Confirm and Submit

Now that you’ve entered all the necessary information, it’s time to review your application before submitting it. Take a moment to carefully go through each section and make sure everything is accurate and up to date. Double-check your personal details, including your name, address, and contact information.

While reviewing your application, you will also have the opportunity to create a unique username and password. These credentials will serve as your access to your E*TRADE account, so make sure to choose something secure and easy to remember.

Once you’re satisfied with your application and have created your login credentials, you’re ready to submit your application. After submitting, you will receive an account number, which you should keep safe for future reference.

Deposit Funds to Activate Your Account

Before you can start trading, it’s important to deposit funds into your E*TRADE account. Remember, you need to deposit a minimum of $500 within 60 days of opening your account to keep it active.

To deposit funds, you can choose from various options, including:

| Deposit Method | Description |

|---|---|

| Electronic Funds Transfer (EFT) | Easily transfer funds from your linked bank account to your E*TRADE account. |

| Wire Transfer | Rapidly transfer funds from your bank to your E*TRADE account, ideal for larger deposits. |

| Check Deposit | Mail a personal or cashier’s check to E*TRADE for deposit into your account. |

Once your funds are deposited, you’ll be ready to start trading and taking advantage of the many opportunities available through E*TRADE.

Now that you understand the importance of reviewing your application, creating your login credentials, and depositing funds, it’s time to complete the process and embark on your trading journey with E*TRADE. Take the next step towards achieving your financial goals!

Options Trading on E*TRADE

E*TRADE provides options trading capabilities for investors who are interested in engaging in more advanced trading strategies. With E*TRADE, you have access to two trading platforms: E*TRADE Web and Power E*TRADE.

These trading platforms offer a wide range of features and tools that can assist you in researching and analyzing potential options opportunities. You’ll have access to real-time quotes, market commentary, and various analytical tools to help you make informed decisions.

When it comes to options trading, E*TRADE allows you to explore different options strategies based on your market outlook. You can select strike prices and expiration dates, test your strategies using analytical tools, and enter orders.

Additionally, E*TRADE offers resources for risk management, which is crucial when trading options. Proper risk management strategies can help you protect your investments and limit potential losses.

Furthermore, E*TRADE prioritizes reliable order execution to ensure that your trades are executed accurately and promptly. With their advanced trading platforms and robust infrastructure, you can have confidence in the execution of your options trades.

Trading Platforms

E*TRADE offers two trading platforms that cater to different levels of options trading experience:

- E*TRADE Web: This platform is user-friendly and suitable for beginner and intermediate options traders. It provides essential tools and features to help you navigate the options market effectively.

- Power E*TRADE: Designed for more advanced options traders, Power E*TRADE offers a comprehensive suite of tools and advanced functionality. It includes features such as customizable charting, advanced order types, and enhanced options analysis.

By using these platforms, you’ll have the necessary tools and resources at your disposal to implement your options trading strategies successfully.

| Features | E*TRADE Web | Power E*TRADE |

|---|---|---|

| Real-time quotes | ✓ | ✓ |

| Market commentary | ✓ | ✓ |

| Research tools | ✓ | ✓ |

| Options analysis | ✓ | ✓ |

| Customizable charting | – | ✓ |

| Advanced order types | – | ✓ |

| Options education resources | – | ✓ |

As you can see from the table above, Power E*TRADE offers additional features such as customizable charting, advanced order types, and options education resources.

Regardless of your level of options trading experience, E*TRADE provides the tools, resources, and platforms necessary to engage in successful options trading. Whether you’re exploring different options strategies, managing risk, or executing trades, E*TRADE has you covered.

E*TRADE Account Features and Benefits

E*TRADE offers a range of features and benefits to its account holders. Take advantage of their commitment to cost-effective investing with no trade commissions for online stock, options, and ETF trades. Additionally, E*TRADE provides access to a diverse range of investment options through their wide selection of no-transaction-fee mutual funds.

With E*TRADE, you can trade a variety of securities, including stocks, bonds, mutual funds, ETFs, options, and futures, giving you the flexibility to build a diversified portfolio.

E*TRADE understands the importance of advanced tools and features for successful trading. They provide two trading platforms, E*TRADE Web and Power E*TRADE, that offer a range of advanced features and tools to enhance your trading experience.

Stay connected to your investments even when you’re on the move with E*TRADE’s mobile app. Available for iOS and Android devices, the app allows you to trade and access account information anytime, anywhere.

Research and analysis are crucial for informed decision-making, and E*TRADE recognizes this. They provide extensive research and data resources, including real-time quotes, market commentary, and access to third-party research providers.

To ensure a seamless trading experience, E*TRADE offers 24/7 customer support through phone, email, and chat. Their team of professionals is ready to assist you and address any questions or concerns you may have.

Table

| Features | Benefits |

|---|---|

| No trade commissions | Cost-effective investing |

| No-transaction-fee mutual funds | Access to a diverse range of investment options |

| Tradable securities | Flexibility to build a diversified portfolio |

| Trading platforms | Advanced features and tools for successful trading |

| Mobile app | Trade and access account information on the go |

| Research and data resources | Access to real-time quotes, market commentary, and third-party research providers |

| Customer support | 24/7 assistance through phone, email, and chat |

Experience the benefits of E*TRADE’s account features and take your trading to the next level.

E*TRADE Ratings and Account Details

E*TRADE has received positive ratings in various categories. Let’s take a closer look at the key details and features of an E*TRADE account.

Account Minimum and Fees

E*TRADE is accessible to investors of all levels with no account minimum requirement. This means you can start investing with any amount you’re comfortable with. Furthermore, E*TRADE does not charge annual or inactivity fees, making it cost-effective for long-term investors.

Stock Trading Costs

E*TRADE offers online stock trades at an affordable cost of $0 per trade. Whether you’re executing a single trade or multiple trades, you can enjoy the benefits of commission-free stock trading.

Options Trades

If you’re interested in options trading, E*TRADE charges a competitive per-contract fee of $0.65. Volume discounts are also available, allowing active traders to further reduce their options trading costs.

Interest on Uninvested Cash

E*TRADE offers a competitive interest rate of 0.01% on uninvested cash. While this rate may be relatively low compared to some competitors, it can still provide you with a small return on your idle funds.

No-Transaction-Fee Mutual Funds

With over 4,000 no-transaction-fee mutual funds available, E*TRADE provides a wide range of investment options. This means you can diversify your portfolio without incurring additional fees.

Tradable Securities

E*TRADE allows you to trade a variety of securities, including stocks, bonds, mutual funds, ETFs, options, and futures. With such a broad range of investment choices, you can customize your portfolio to suit your specific investment goals.

Trading Platforms and Mobile App

E*TRADE offers two trading platforms: E*TRADE Web and Power E*TRADE. Both platforms provide free access to all customers and offer advanced features and tools for efficient trading and portfolio management. Additionally, E*TRADE’s mobile app is available for iOS and Android devices, allowing you to trade and monitor your account on the go.

Research and Data Resources

E*TRADE provides extensive research and data resources to assist you in making informed investment decisions. From real-time quotes and market commentary to third-party research providers, E*TRADE offers a wealth of information to support your investment strategy.

Customer Support

E*TRADE understands the importance of customer support and provides assistance 24/7. Whether you have questions or need help with your account, you can reach out to E*TRADE’s customer support team via phone, email, or chat.

As you can see, E*TRADE offers a comprehensive set of features and benefits to enhance your trading and investing experience. From its accessible account minimum to low stock trading costs, extensive investment choices, advanced trading platforms, and helpful customer support, E*TRADE is designed to meet the needs of investors at any level. Take advantage of E*TRADE’s range of services and start your investing journey today.

Is E*TRADE Right for You?

E*TRADE offers a range of options to suit the needs of different investors. Whether you are a frequent trader or a beginner investor, E*TRADE has features and resources that can support your investment journey.

For Frequent Traders

If you are an active trader, E*TRADE provides advanced trading platforms and tools to enhance your trading experience. These platforms offer real-time quotes, market commentary, and sophisticated charting capabilities. With access to these resources, frequent traders can make informed decisions and execute trades efficiently.

For Beginner Investors

If you are new to investing, E*TRADE offers user-friendly platforms and comprehensive educational resources. The platforms are designed to be intuitive and easy to navigate, allowing beginner investors to quickly grasp the basics of online trading. Additionally, E*TRADE provides educational materials, webinars, and tutorials to help you build your knowledge and confidence.

Research and Data

For investors who value research and data, E*TRADE offers a wide range of options. They provide real-time quotes, market analysis, and third-party research providers to help you stay informed about the markets and make well-informed investment decisions. By leveraging these resources, you can access valuable insights and stay ahead of market trends.

Retirement Planning

E*TRADE recognizes the importance of retirement planning and offers various options to support your long-term goals. They provide Individual Retirement Accounts (IRAs) to help you save for retirement in a tax-advantaged manner. Additionally, E*TRADE offers retirement planning advice and resources to assist you in creating a personalized retirement strategy.

Robo-Advisor Service

For investors who prefer a managed approach to investing, E*TRADE offers a robo-advisor service called E*TRADE Core Portfolios. This service utilizes advanced algorithms to manage your portfolio and provide recommendations based on your investment goals and risk tolerance. E*TRADE Core Portfolios charges an annual advisory fee of 0.30%.

Overall, whether you are a frequent trader, beginner investor, or someone planning for retirement, E*TRADE provides options and resources to support your financial journey. Consider your investment goals and preferences to determine if E*TRADE is the right fit for you.

How We Review Brokers and Customer Support

Our broker reviews are based on a standardized methodology that takes into account various factors. We analyze key aspects such as account minimums, stock trading costs, options trades, account fees, research and data offerings, and customer support options. By evaluating these factors, we provide an objective assessment of the overall quality and performance of brokers.

Review Methodology

Our review methodology is designed to ensure transparency and consistency in our assessments. We thoroughly research and analyze each broker, considering the following criteria:

- Account minimum: We examine the minimum deposit required to open an account, as well as any ongoing balance requirements.

- Stock trading costs: We evaluate the commission fees charged for online stock trades, taking into consideration any volume discounts or promotional offers.

- Options trades: We assess the cost per contract for options trades, comparing pricing structures and availability of options strategies.

- Account fees: We analyze any fees associated with the broker’s trading platform, account maintenance, or additional services.

- Research and data offerings: We review the research tools and resources provided by the broker, such as market analysis, real-time quotes, and third-party research providers.

- Customer support options: We evaluate the availability and quality of customer support channels, including phone, email, and chat support.

| Broker | Account Minimum | Stock Trading Costs | Options Trades | Account Fees | Research and Data | Customer Support |

|---|---|---|---|---|---|---|

| E*TRADE | No account minimum | $0 for online trades | Commission-free | No annual or inactivity fees | Extensive resources available | Phone, email, and chat support 24/7 |

E*TRADE stands out in all these categories, making it a top choice for investors. With no account minimum and low stock trading costs, it offers accessibility and affordability. Commission-free options trades and no annual or inactivity fees further enhance the value for investors. E*TRADE also provides extensive research and data resources, empowering investors with the information they need to make informed decisions. Lastly, its 24/7 customer support ensures that investors have access to assistance whenever they need it.

Conclusion

Opening an E*TRADE account is a simple and quick process that provides you with access to a wide range of features and benefits. Whether you’re interested in online trading or stock market investments, E*TRADE offers a secure and user-friendly platform that caters to both frequent traders and beginner investors.

With an E*TRADE account, you can choose from a variety of tradable securities, including stocks, bonds, mutual funds, ETFs, options, and futures. The platform also provides advanced trading tools and platforms, such as E*TRADE Web and Power E*TRADE, which offer real-time quotes, market commentary, and a wealth of research and data resources.

Additionally, E*TRADE’s mobile app allows you to trade and access your account on the go, ensuring that you have the flexibility to manage your investments anytime and anywhere. Furthermore, the company offers 24/7 customer support through phone, email, and chat to assist you with any questions or concerns you may have.

Whether you’re starting your investment journey or looking to diversify your portfolio, E*TRADE is committed to providing you with secure trading and reliable order execution. Take the first step towards your online trading and investing goals by opening an E*TRADE account today.

FAQ

How do I open an E*TRADE account?

Opening an E*TRADE account is a straightforward process. Visit the designated webpage and select the option for an individual account. If you are a new customer, provide your name and email address. If you are an existing customer, enter your user ID and password. Follow the steps to enter your personal information, set up your account preferences, review your information, and submit your application. Once approved, you can deposit funds into your account.

What information do I need to provide to open an E*TRADE account?

To open an E*TRADE account, you will need to provide your residential address, date of birth, Social Security number or Employment Identification Number, contact information for your current employer (if applicable), and information about the bank account you will use to fund your E*TRADE account.

Is there a minimum deposit required to open an E*TRADE account?

Yes, E*TRADE requires a minimum deposit of 0 within 60 days of opening the account to keep it active.

How much does E*TRADE charge per trade?

E*TRADE charges .99 per trade for fewer than 150 trades per quarter and .99 per trade for more than 150 trades.

What if I encounter issues during the application process?

If you encounter any issues during the application process, E*TRADE offers phone support and an online chat feature to assist you.

Does E*TRADE offer options trading?

Yes, E*TRADE offers options trading. They provide two trading platforms, E*TRADE Web and Power E*TRADE, which offer real-time quotes, market commentary, and a variety of tools to help you research and analyze potential options opportunities.

What features and benefits does an E*TRADE account offer?

E*TRADE offers a range of features and benefits, including no trade commissions for online stock, options, and ETF trades, a wide selection of no-transaction-fee mutual funds, access to various tradable securities such as stocks, bonds, mutual funds, ETFs, options, and futures, two trading platforms with advanced features, a mobile app for trading on the go, extensive research and data resources, and 24/7 customer support.

What are E*TRADE’s account ratings and details?

E*TRADE has no account minimum, low stock trading costs, commission-free options trades, no annual or inactivity fees, more than 4,000 no-transaction-fee mutual funds, and a mobile app available for iOS and Android devices. E*TRADE provides extensive research and data resources, as well as 24/7 customer support through phone, email, and chat.

Is E*TRADE suitable for me?

E*TRADE caters to both frequent traders and beginner investors. They provide user-friendly platforms, extensive educational resources, retirement planning assistance, and a robo-advisor service for managed portfolios. E*TRADE also offers options for those who prefer a wide range of tradable securities and research and data options.

How do you review brokers and customer support?

Our broker reviews are based on a standardized methodology that takes into account various factors, including account minimums, stock trading costs, options trades, account fees, research and data offerings, and customer support options.