The Dummy’s Journey to Financial Success: Simple Steps for Personal Finance Mastery

Are you tired of feeling like a financial dummy? Do terms like “compound interest” and “budgeting” make your head spin?

Well, don’t despair! In this article, we will guide you on the journey to financial success and help you master your personal finances.

Whether you’re a recent graduate, a new parent, or simply someone looking to improve your money management skills, we’ve got you covered. Our simple steps and practical advice will empower you to take control of your financial future.

No more confusion or anxiety when it comes to money matters. We’ll break down complex concepts into easy-to-understand language and provide practical tips and strategies to help you make smart financial decisions.

From creating a realistic budget to saving for retirement and everything in between, our comprehensive guide will equip you with the tools and knowledge to achieve financial success. It’s time to leave the role of the financial dummy behind and embark on a journey towards financial mastery. Get ready to transform your financial future today!

Brand Voice: Friendly, Informative, Empowering. (Please incorporate the given brand voice into the introduction.)

Understanding personal finance

Understanding personal finance is the first step on your journey to financial success. It’s crucial to grasp the basic concepts and principles that underpin sound money management. This knowledge will serve as a foundation for all your future financial decisions.

Financial literacy is not something that comes naturally to everyone, but it’s a skill that can be learned and developed. By educating yourself about personal finance, you’ll gain the confidence to navigate the complex world of money and make informed choices.

Importance of financial literacy

Financial literacy is more than just understanding the basics of personal finance. It’s about having the knowledge and skills to make sound financial decisions that align with your goals and values.

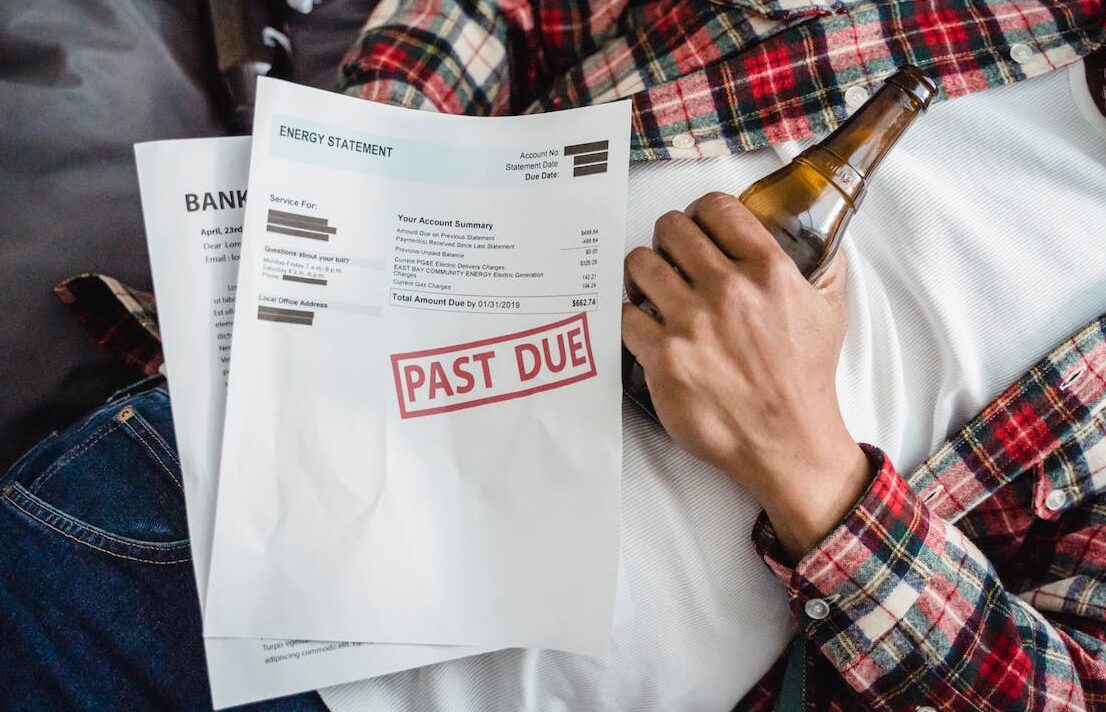

Without financial literacy, you may find yourself falling into common pitfalls, such as overspending, accumulating debt, or failing to save for the future. By improving your financial literacy, you can avoid these mistakes and set yourself on a path to success.

Setting financial goals

Setting clear financial goals is essential for achieving financial success. Goals give you direction and motivation, helping you stay focused on what’s most important to you.

When setting financial goals, it’s important to make them specific, measurable, achievable, relevant, and time-bound (SMART). This framework ensures that your goals are realistic and actionable.

Creating a budget

Creating a budget is a fundamental tool for managing your money effectively. It allows you to track your income and expenses, identify areas where you can save, and ensure that you’re living within your means.

To create a budget, start by listing all your sources of income and then categorize your expenses. Be sure to include both fixed expenses (such as rent or mortgage payments) and variable expenses (such as groceries or entertainment). Review your budget regularly and make adjustments as needed.

Saving and investing for the future

Saving and investing are key components of personal finance. Saving allows you to build an emergency fund and cover unexpected expenses, while investing helps you grow your wealth over time.

When saving, it’s important to set aside a portion of your income regularly. Aim to save at least 20% of your income, if possible. Consider opening a separate savings account to keep your savings separate from your everyday spending.

Managing debt and credit

Managing debt and credit responsibly is vital for your financial well-being. Debt can quickly spiral out of control if not managed properly, leading to financial stress and difficulties.

Start by understanding your current debt situation. Make a list of all your debts, including the amount owed, interest rates, and minimum monthly payments. Develop a debt repayment plan, focusing on paying off high-interest debts first.

Building an emergency fund

Building an emergency fund is an essential part of financial planning. An emergency fund provides a safety net for unexpected expenses, such as medical bills or car repairs.

To build an emergency fund, start by setting a savings goal. Aim to save at least three to six months’ worth of living expenses. Consider automating your savings by setting up automatic transfers from your checking account to your emergency fund.

Understanding insurance and risk management

Insurance plays a crucial role in managing risk and protecting your financial well-being. From health insurance to auto insurance, it’s important to understand the different types of coverage available and choose the ones that best fit your needs.

Research the insurance options available to you and assess your risk tolerance. Consider consulting with an insurance professional to ensure that you have the right coverage for your specific situation.

Planning for retirement

Planning for retirement is a long-term financial goal that requires careful consideration and preparation. Start by estimating how much income you’ll need in retirement and then develop a savings plan to achieve that goal.

Consider taking advantage of retirement accounts such as 401(k)s or individual retirement accounts (IRAs). Maximize your contributions to these accounts, especially if your employer offers a matching contribution.

Conclusion: Taking control of your financial future

Congratulations! You’ve made it to the end of our comprehensive guide to personal finance mastery. By following the simple steps outlined in this article, you can take control of your financial future and achieve the success you deserve.

Remember, financial mastery is a journey, not a destination. Keep educating yourself, stay disciplined, and make smart financial choices. With time and effort, you’ll build the financial freedom and security you’ve always dreamed of.

So, leave the role of the financial dummy behind and embark on your journey towards financial mastery. The power is in your hands. Start transforming your financial future today!